Blockchain this, Bitcoin that. Since 2010, the world has gone crazy about distributed ledger currencies and assets, much of the hype based on how Bitcoin price exploded.

In 2008, “Satoshi Nakamoto” invented Bitcoin. Bitcoin is a decentralized digital currency with all transactions recorded in a distributed digital ledger that we refer to as a blockchain.

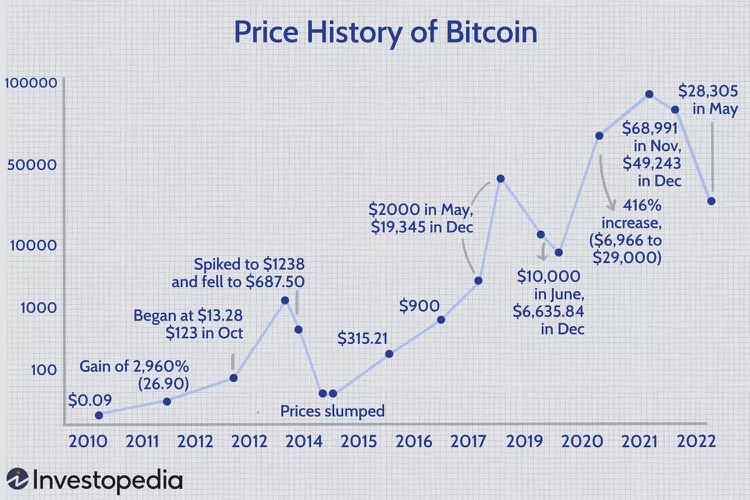

Bitcoin started with humble pricing but soon skyrocketed in value. From it’s initial penny value, it has grown in value, albeit with significant dips in value.

Source: Investopedia

In related markets and products, there have been very public failures that we can examine, legitimate and otherwise.

Do bear in mind that crytocurrencies are new and fundamentally in a blind spot where regulators are not sure of who should be responsible and how customers can be protected. The inherent risk of financial loss is largely unmitigated.

2014: The Birth of OneCoin

Ruja Ignatova founded OneCoin in 2014, riding high on the success of BitCoin. OneCoin was not actually a distributed ledger but rather a centralised ledger – but the people came. It was a hype-based product that still exists today, no matter the history.

It was actually a multi-level marketing scheme (commonly referred to as a “Ponzi” scam). Ignatova managed everything from volumes of OneCoin available to buy to the “price” of the asset. The price was actually displayed on the OneCoin website and, of course, regularly increased in value. At least the text, the numbers on the website, displayed higher values on a regular basis.

You can follow the story as investigated by Jamie Bartlett of the BBC. His “Missing Cryptoqueen” podcast tells how Ignatova started, how things became more and more fragile over time and how she disappeared after taking a flight from Sofia to Athens.

While it is not truly a blockchain-based currency or exchange, there are lots of victims who lost money simply on the basis of buying into the hype.

2018: QuadrigaCX CEO “dies”

Shortly after Ignatova disappeared, Gerald Cotten, the CEO of QuadrigaCX, a cryptocurrency exchange based in Canada, went to India on vacation and mysteriously died. His death was confirmed by his widow, Jennifer Robertson.

Believable? At the same time, CA$215 million dollars in cash and cryptocurrency vanished. Still believable? Maybe not….

Cotten also left a legacy for the exchange users; the cold wallet was on his personal PC and only he knew the password – which basically meant the assets in the exchange were no longer available and people lost money.

Many suspect the death to be faked and Cotton is living life as a very rich man.

Whatever the truth is, the fragility of exchanges where there is a single point of failure exists (be that technology or people) will always be a risk. The more successful the exchange becomes, the more assets it handles on its clients’ behalf and the more temptation for those running the platforms to ride off into the sunset with an e-wallet full of cryptocurrency.

2022: FTX

This brings us to today. FTX.

FTX was another cryptocurrency exchange that has gone bust. Rumours are that it might have been hacked but these are not yet confirmed.

FTX allegedly was managing assets worth an estimated $32 billion. CEO Sam Bankman-Fried was also involved in another company, Alameda Research, who appear to have been the destination of up to $10 billion of assets from FTX – loaned, donated, nobody really knows.

The company had star quarterback Tom Brady even featured in a commercial for FTX:

It was not all good news for Tom, though, as he seems to have lost a lot of money in the collapse too.

This seems to be yet another case of a barely-regulated company growing rapidly with what might be one or a few people at the top who found the masses of assets too shiny and attractive to resist. The SEC is investigating, the company is in administration – at some point, the story may come out.

Bank of International Settlements outlook

Right now, it seems around a fifth of Bitcoin investors are holding theoretic gains on their portfolios. The Register reports that BIS, located in Basel, Switzerland, has performed an analysis and see “between 73 and 81 percent of retail Bitcoin buyers” likely to be holding assets worth less than when they invested.

It’s clear that there are many risks here. Boxes of magic beans. Regulation lagging behind. Greed. Using exchanges rather than managing your own wallet comes with some risks. And, maybe most importantly, scammers are quick to appear in this space….or they are in the space and then turn.

It’s the wild wild west in many ways so tread carefully.